Dear Readers,

The market has taken its first steps in this new year and sent initial signals about which themes are important. Unlike what we could hope for in the autumn of last year, it does not appear that the topic of inflation and interest rate policy will move the markets less in 2024. For this, the market and the FED leaned too far out of the window at the end of the year and are now in no position to cushion negative surprises well. But more on that later. First, I would like to guide you through the new important theme of this year: elections!

Super Election Year 2024

Depending on the calculation, 50% of the world's population will cast their vote this year. This year will be a decisive and incisive year for the political direction of the world and a barometer for the mood of its population. Of course, the US presidential election is the most important topic, but before we analyze the impact of the Americans in detail, first a look at the most important upcoming elections worldwide.

Source: Wikipedia

The elections in Russia can certainly only be considered a theoretical event in the current situation. Nevertheless, the elections there will not pass by the media and the topic of Russia and the threat situation will come into sharper focus in the weeks before. The Indian elections are important for the global economy. Much points to a re-election of the current president, but the rhetoric can be revealing about the direction in which this (future) economic heavyweight will orient itself.

In summer, a whole series of state elections will take place here with us. The impact on the global situation is likely to be limited, but this mood barometer and the election campaign before it will be revealing for the chances of the German business location, which is increasingly losing its competitiveness due to poor infrastructure and high costs.

US Elections

The important topic for the stock markets and the topic that will certainly accompany us most this year, at least from the media, is the American election. Much indicates that Donald Trump will again be the Republican candidate. The primaries in Iowa, which he won by a landslide, are not yet decisive, but the latest polls also indicate a tremendous lead for Trump. In a representative poll by MorningConsult in the first week of January, 43% of votes went to Joe Biden, 42% to Donald Trump. All other candidates together received only 11% of votes.

Therefore, we can assume with high probability that we will see another showdown between Biden and Trump in autumn, and personally, a re-election of Trump would surprise me very little. The stock market cycle of election years has a quite characteristic course.

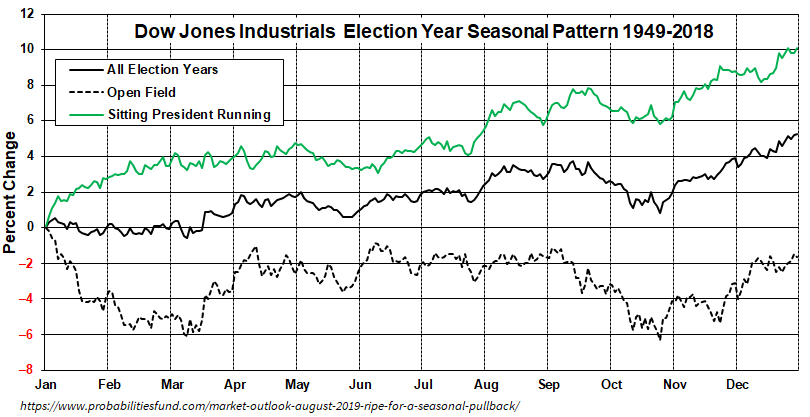

The chart is from 2019, but that doesn't matter. It is particularly interesting because it shows the big difference between election years in which the incumbent president, as in this year, runs for re-election. These years are particularly strong on average and also show a slightly positive trend at the beginning of the year. Typically, election years weaken in April and May, then rise over the summer until late August. Then comes the quiet period directly before the elections and the market usually falls in early autumn and reaches a low point shortly before the election in November, from which the year-end rally starts.

Already in 2016, when Trump's first election became increasingly likely, the media predicted a major stock market crash. I remember well the major warning signals in analyses and media. Hardly anyone could imagine a good time on the stock market under Donald Trump.

Course of the S&P 500 2016. Marked is the election of Donald Trump.

The election decision marked, as often in election years, the low of the short consolidation and the market began a hardly imaginable rally that only ended about 16 months later and 30% higher. Despite the difficult phase around the trade war with China, Donald Trump's stock market record was impressive. Whether it would happen again this time is questionable.

The current election is likely to be under rare circumstances, as the ability to govern as well as the transfer of power must actually be questioned. Already after Trump's last defeat in 2020, the handover did not go smoothly, which is why he is also being charged by the US Department of Justice's special counsel with obstructing the transfer of power. Conversely, one must seriously ask whether the camps of American politics are now so divided that Trump as president and the government around him are actually no longer capable of making decisions. This question had already prompted Fitch last summer to downgrade the creditworthiness of the USA. A blocked government is an uncertainty and weakness factor that the market would certainly not like.

Interest Rates and Inflation

The second obvious topic of this year is inflation and, even more so, the central bank's interest rate policy. The Federal Reserve (FED) was significantly involved in making the year-end as strong as it turned out. This behavior left me shaking my head, because this one-sided and fueling policy is dangerous in the long term and takes away room for maneuver. If inflation is more persistent than now assumed in the optimistic scenarios, a great opportunity for a smooth course was squandered there.

The ECB also clearly countered this in January and sent a clear signal that no interest rate cuts are planned before summer. As we saw above, election years in which the incumbent president runs again are statistically strong stock market years. If the incumbent president is a Democrat, the statistics are even better. From this perspective, we therefore have the best conditions and the consideration of how much the American administration and especially the FED keeps prices high for a positive election climate is a valid question. In the trade war of 2018, Powell coldly raised interest rates despite all difficulties. Last year there would have been a lot of room in December, yet the opposite happened.

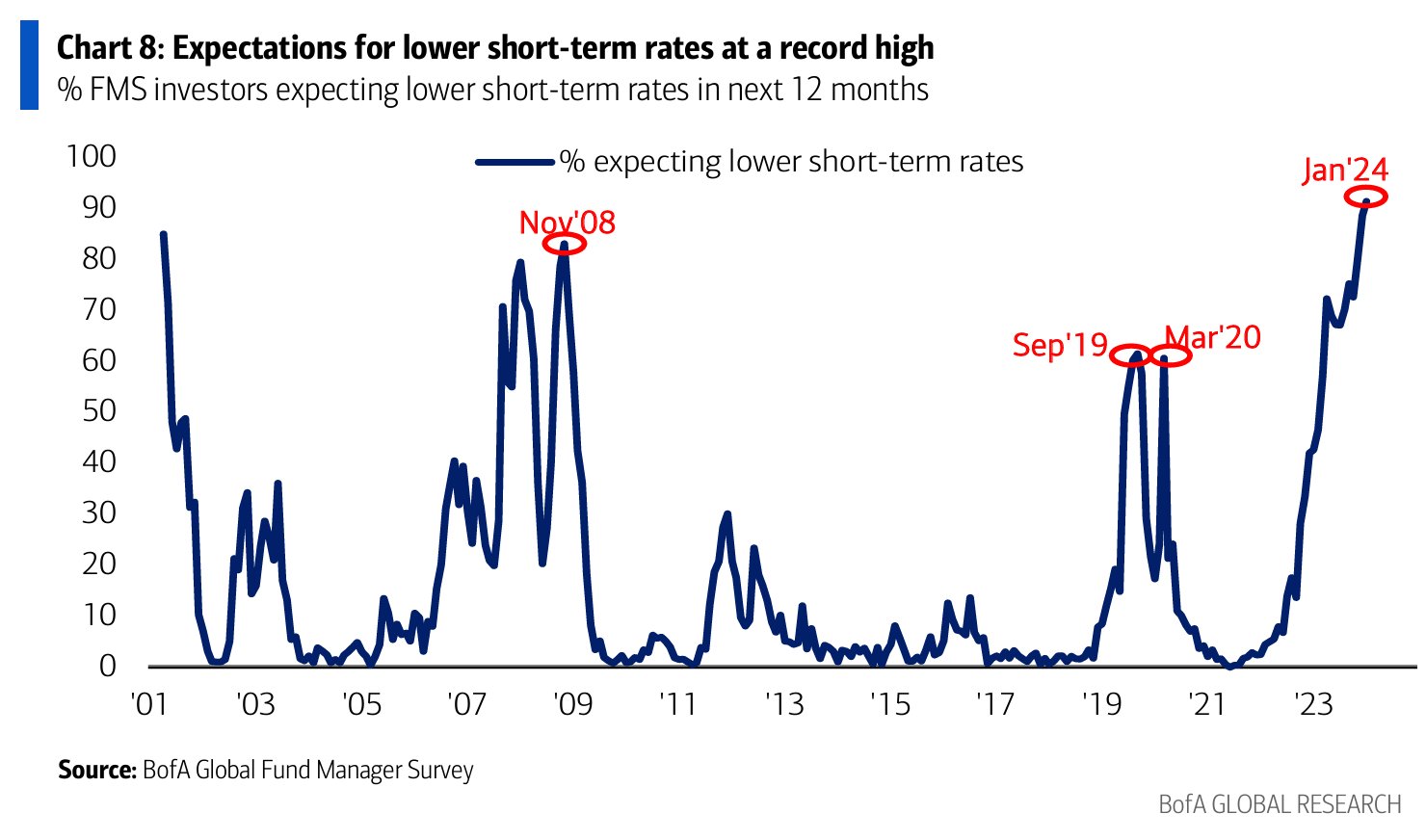

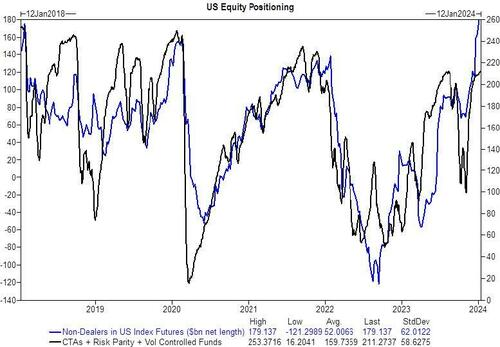

So there is very likely great interest in the background in the USA to keep the market stable and that should also be a reason for the positive statistics in election years. However, the uncontrollable factor of inflation remains, which could push the Federal Reserve towards a more defensive path. Meanwhile, expectations for friendly monetary policy are extremely high. By the end of the year, the market expects an interest rate cut of 1.5% to an interest rate corridor of 3.75 to 4.25%. This is significantly less than the 1.0% actually indicated by the FED. This discrepancy is puzzling and so far I have not found a good explanation. And the expectations have already declined significantly during January.

Bereit für bessere Investment-Entscheidungen?

Starten Sie noch heute mit Ihrer kostenlosen Testphase - Aktienanalyse mit künstlicher Intelligenz.

Volle Transparenz | Voller Zugriff | Jederzeit kündbar

Expectations for lower interest rates are at an absolute peak and this type of expectation has typically been part of a very difficult and volatile market environment in the past.

Recession

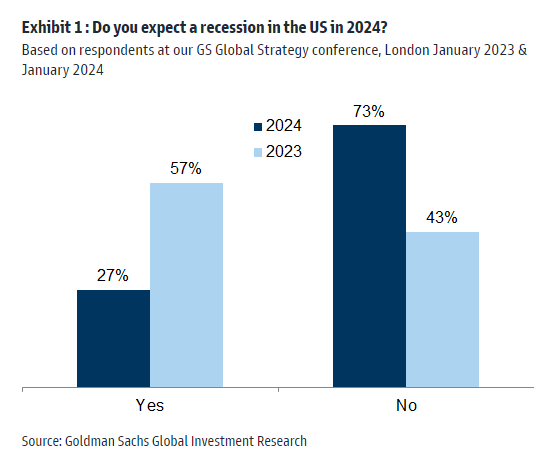

So expectations are high. These high expectations are also reflected in the topic of recession. While a recession was still generally expected in the winter of last year (which I had my doubts about), this recession has not yet materialized and sentiment has reversed. A little over a year ago, we were heading towards the most anticipated recession of all time. Now 73% expect a soft landing, i.e., that there will only be a brief slowdown in growth, but no decline and the recession will pass us by completely.

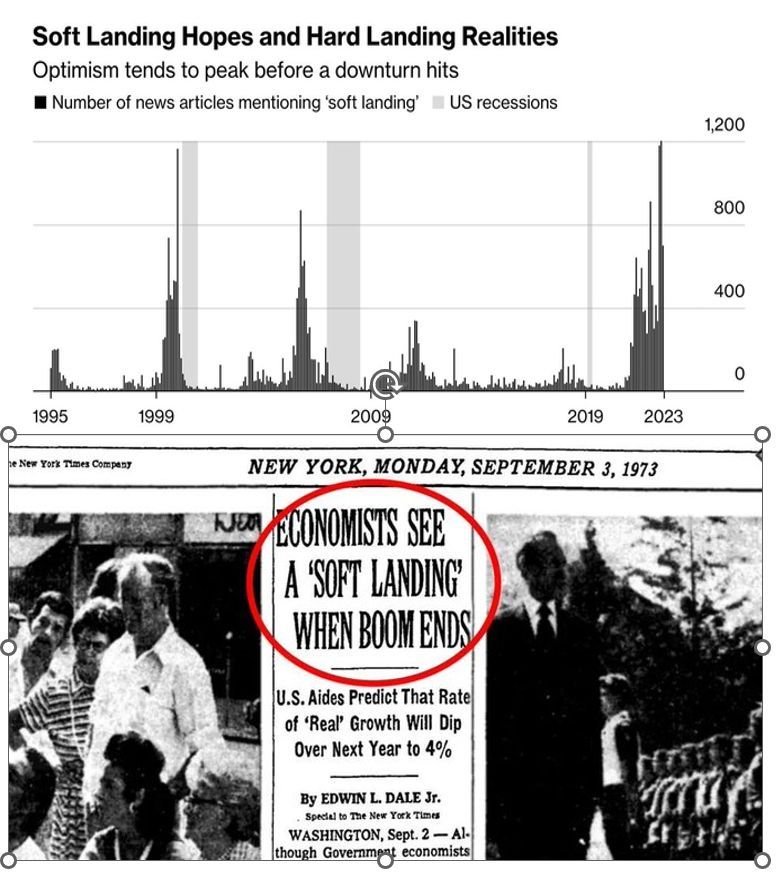

Expectations have thus changed massively and where a year ago there were great opportunities in the pessimistic mood, dangers through euphoria have now taken hold. The probability that the expectations of market participants will be disappointed in one way or another is significant. According to the Global Investment Letters, expectations of a soft landing are usually particularly high when the recession is very close.

Source: https://www.linkedin.com/posts/jonathanbaird88_soft-landing-hopes-and-hard-landing-realities-activity-7155159751989895168-TdvK?utm_source=share&utm_medium=member_desktop

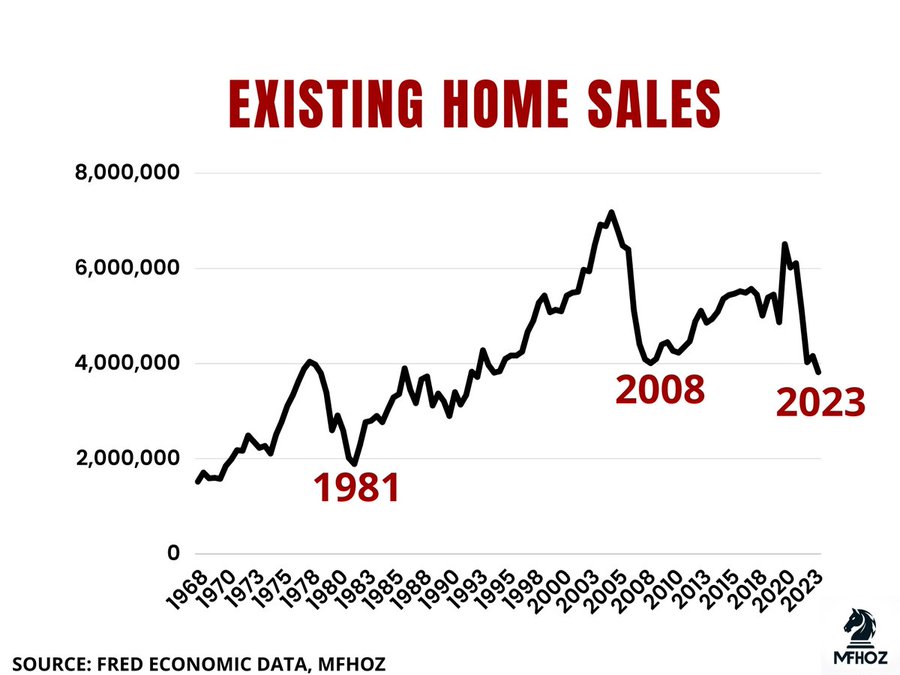

The economic situation is also often particularly good just before an impending recession. In November and December we saw the strongest improvement in the economic situation in two decades. This was also a reason for the extreme rally of recent times, which surprised me. There are a whole series of discrepancies between underlying developments and their reflection in prices and valuations. For example, stocks from the homebuilding sector were strong winners recently. On the other hand, home sales have collapsed drastically and are at their lowest level since 2008.

Source: https://twitter.com/MFHoz

The yield curve is also sending warning signals. After being inverted for a long time, i.e., short-term bonds yielding higher returns than long-term ones, it is now turning back into normal territory where lending money for longer also yields more interest. This return to normality is another good indicator of a recession. However, this topic has been chewed over for years now, because many times the first inversion is already evaluated as an indicator, which is wrong. Therefore, many market participants are tired of this indicator.

Conclusion

We have a problem. There are a whole series of warning signals and questionable relationships that point to dangers. Market participants seem to be quite indifferent to this danger after the breakout of the markets. We haven't even addressed possible escalations between the USA and China, perhaps especially with Trump as president. Also, the debt burden of the USA and other countries under the new interest rate development or the dwindling dominance of the dollar as a world reserve currency are still topics lurking in the background.

We have good indicators that make a recession likely again. Now, a recession in and of itself is not an indicator of falling markets. But in combination with a broad mass of investors fixated on the soft landing, the surprise can have nasty consequences.

Source: Goldman Sachs

Now, on the one hand, we are in an election year and on the other hand in strong momentum. Such situations can push themselves to ever greater heights purely from their own energy. The longer the state of enthusiasm persists and is not slowed by clear facts, the further it pushes itself to new heights purely through self-feeding euphoria. This is how bubbles form. This type of movement often only ends with clear and unmistakable reality and the accompanying negative surprises (recession, inflation, ...).

This means that even though many warning signals are flashing, it is currently hardly possible to determine an end to the upward movement and this end can easily be postponed until next year. However, the downward turn can occur quickly through a catalyst. Until then, naive, euphoric markets are often characterized by particularly strong increases.